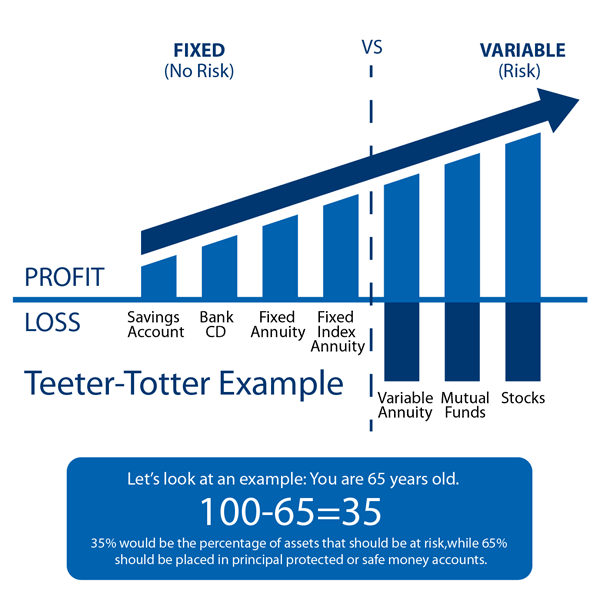

When planning for retirement, and especially income in retirement, it is necessary to start with a standard calculation to examine risk. That base guideline of how to manage risk is done through what is called The Rule of 100.

The Rule of 100 is a guideline accepted by many people in the financial services industry that outlines an appropriate amount of risk you should carry in your portfolio based on your age and time horizon to retirement.

Very simply stated, you take the number 100 and subtract your age, the number remaining should be the percentage of your portfolio that is at “risk” in the stock market or invested in securities. Remember, this risk is defined as money that is not principal-protected.

But remember, it’s not just about age—each person’s risk tolerance is unique to them.